HUTCHINSON, Kan. — The Hutchinson City Council will consider the ordinance for an additional sales tax added on to activities at the new Amber Hotel property as part of its meeting on Tuesday.

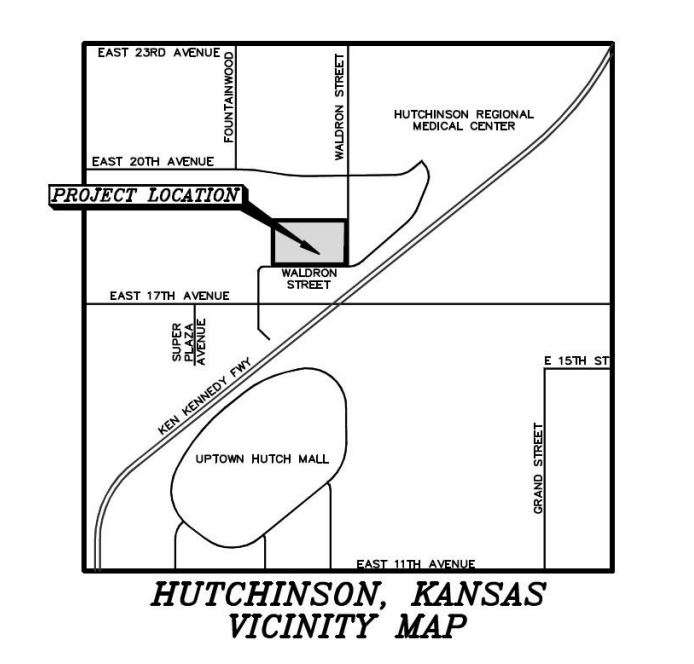

The City Council has entered into a development agreement with Amber Hotel LLC to design, develop, construct, operate, and maintain a hotel, conference center, and restaurant at 1715 N Waldron.

As part of this agreement, it states that the City has authority to establish a CID for this location. Amber Hotel petitioned for a CID. Notice of the public hearing has been published in the Hutchinson News.

The provided Ordinance establishes a CID to collect an additional 2% sales tax by businesses located on the property as described. It will only apply to businesses located on the tracts of land used for the hotel, conference center, and restaurant, and will not apply to the City as a whole.

The CID is authorized to collect up to $18,000,000 to reimburse costs for the construction, redevelopment, renovation, and procurement of certain improvements within the district. The CID will remain in effect for 22 years or until $18,000,000 of CID sales tax is collected.

If approved, once the project is complete, the City will notify the Kansas Department of Revenue to commence the start of CID sales tax collections. The City will receive the CID proceeds from the State and reimburse Amber Hotel for any eligible expenses.

There are other properties in Hutchinson that are under CID provisions, and this is relatively routine with new developments in the area.

The Hutchinson City Council meets at 9 a.m. Tuesday at City Hall.

CLICK HERE to download the Hutch Post mobile app.

CLICK HERE to sign up for the daily Hutch Post email news update.