NICK GOSNELL

Hutch Post

HUTCHINSON, Kan. — USD 308 Budget Director Sheila Meggers provided a presentation to the Board of Education Monday night that outlined how the district gets its money and how it spends that money.

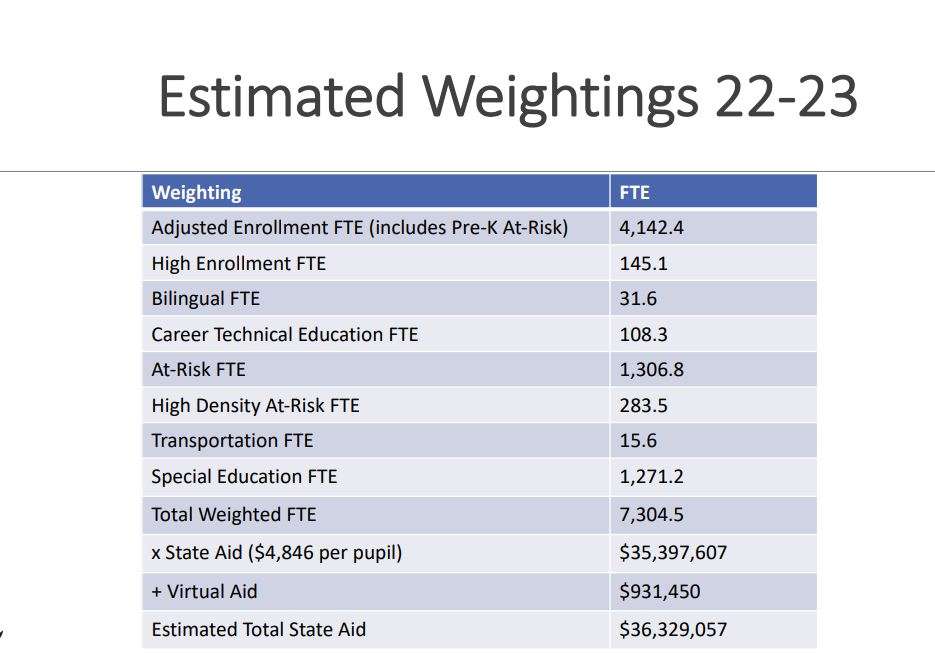

The state funding is based on $4,846 per pupil, but it isn't quite that simple because weightings allow for the district to get additional funding for students that will cost more to educate.

This student count with additional weightings is roughly in line with what it was in 2019-2020 before the pandemic.

Even though the actual enrollment in the district has gone down, the At-Risk weighting has come up almost to match it.

The lion's share of the funding for the district comes down from either the state or federal level.

Though obviously, taxpayers also pay state and federal taxes in addition to their local property tax, it's important to explain that it is those higher level policymakers that decide a lot of how much money comes in, rather than the local school board.

So, how is the money spent? A lot of it goes to instruction.

Here is that same money, as a pie chart, to show the percentages.

Meggers said the mill levy for the district is actually projected to go down.

According to the Revenue Neutral Rate slide from Meggers presentation, the district is due to levy $6,036,676 in property tax on their approximately $78 million budget. This is down from $6,084,855 last year. The main reason they can do that is that bond and interest is shrinking quickly, with the district's bonded indebtedness down just over $9 million from last year. The Capital Outlay portion of the mill levy is going up, though, and thus they are required to hold the Revenue Neutral Rate hearing.

The Revenue Neutral Rate Hearing will be held at 5:45 p.m. and the Budget hearing at 5:50 p.m. on September 12.