MARC JACOBS

Hutch Post

Reno County is taking a closer look at how to invest in community priorities—and county leaders want to hear from residents before any decisions are made.

Check your mailbox as roughly 4,000 randomly selected residents will receive a survey developed in partnership with Wichita State University’s Public Policy and Management Center (PPMC). The survey will help county officials better understand public priorities as they consider potential community investment strategies and the future of county sales tax funding.

“We want to ensure any funding decisions reflect what matters most to the people who live here,” county officials said in a statement. “This survey is a key step in that process.”

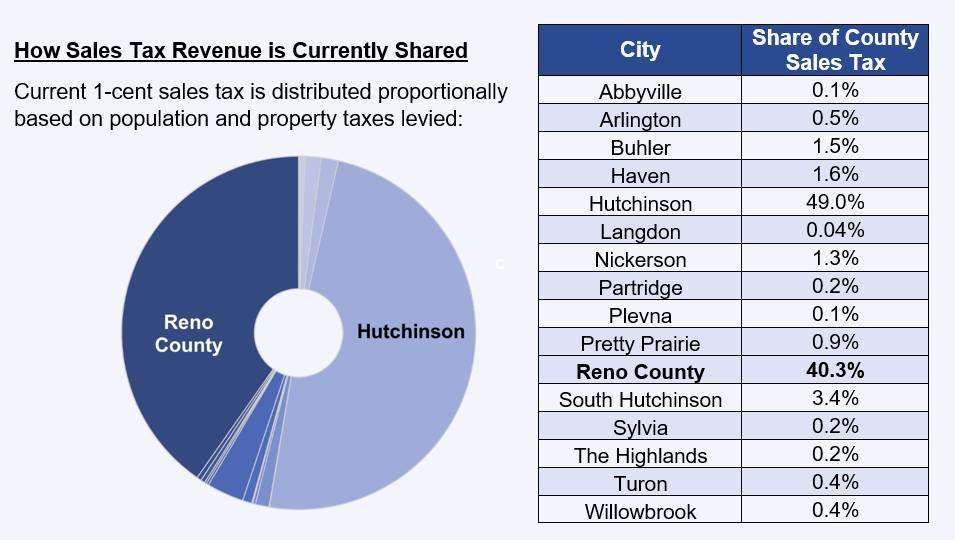

Here's how the current sales tax works

Reno County’s existing 1-cent sales tax doesn’t just support county government—its benefits are shared across the entire county. Revenue from the tax is distributed to all 15 cities in Reno County based on population and property taxes levied.

That funding is vital for cities large and small, particularly those with limited tax bases.

Where the money goes

According to county and city officials, most of the shared sales tax revenue supports basic operations rather than special projects. Cities depend on the funds to maintain core services like:

- Water and sewer systems

- Road repair and maintenance

- Building upkeep and facility needs

- Equipment replacement

- Public safety and other essential services

“It’s what keeps the lights on, the water flowing, and the streets drivable,” one city administrator noted.

Infrastructure remains priority number one

In conversations with local leaders, infrastructure emerged as the top concern in every community. Whether it’s replacing aging water lines, repairing roads, or upgrading outdated facilities, city officials say the sales tax revenue is a crucial lifeline.

“They simply don’t have enough revenue on their own to keep up,” the county said. “This partnership ensures all residents benefit from shared resources, no matter where they live.”

Residents selected for the survey are encouraged to complete and return it as soon as possible. County officials say the results will guide future discussions about funding needs—and whether changes to the existing sales tax might be necessary.