MARC JACOBS

Hutch Post

Hutchinson voters will decide March 3 whether to double the city’s local sales tax, a move that city officials say would significantly increase revenue but would also raise the amount residents pay on everyday purchases.

The proposal would add a new 0.75% city sales tax to Hutchinson’s existing 0.75% tax, bringing the total local rate to 1.5%. The current sales tax is divided between 0.50% for general use and 0.25% distributed among Strataca, the Cosmosphere, street improvements, and property tax relief.

Data provided by the City of Hutchinson shows $687,420 in sales tax revenue in January 2026. Total collections for 2025 were $9,051,442.

Under the current rate, a resident who spends $1,000 per month on taxable purchases within the city pays about $7.50 in local sales tax, or $90 annually. The tax applies to all purchases, including groceries, because Kansas law does not allow cities to exempt food from local sales taxes.

If voters approve the increase, that same spending level would result in $15 per month in local sales tax, or $180 per year.

Using the city’s figures, officials estimate that if the higher rate had been in place in January, Hutchinson would have collected $1,374,840 in sales tax revenue for the month. Applied to all of 2025, the higher rate would have generated an estimated $18,102,884.

Supporters of the measure argue the additional revenue would strengthen city finances and support long-term infrastructure and service needs. Opponents have raised concerns about the cumulative tax burden on residents, particularly those on fixed incomes.

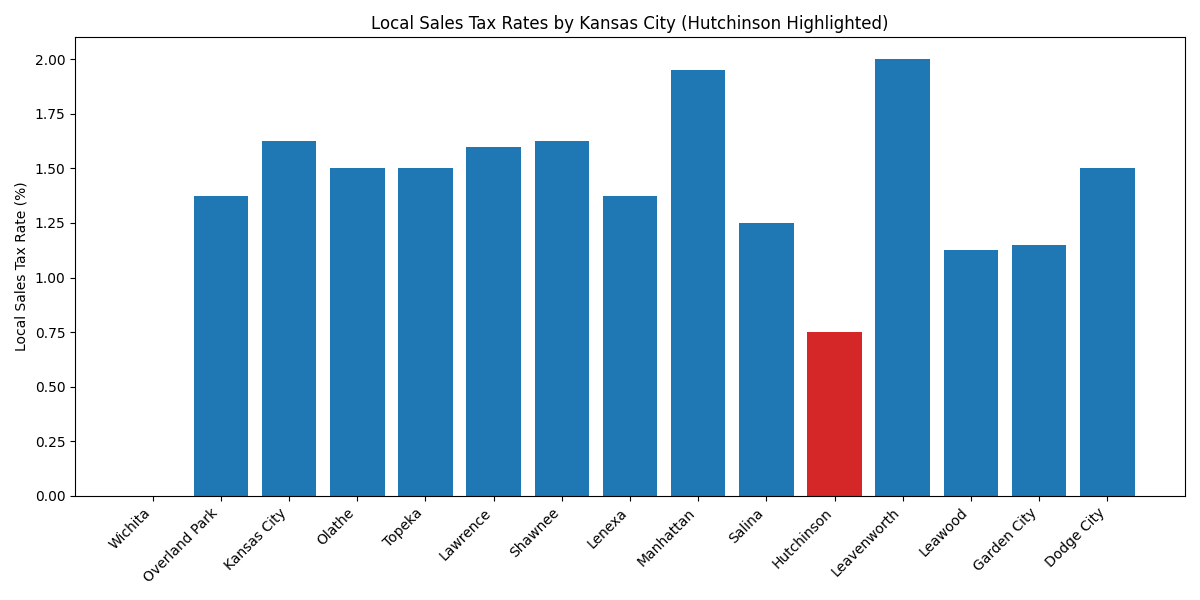

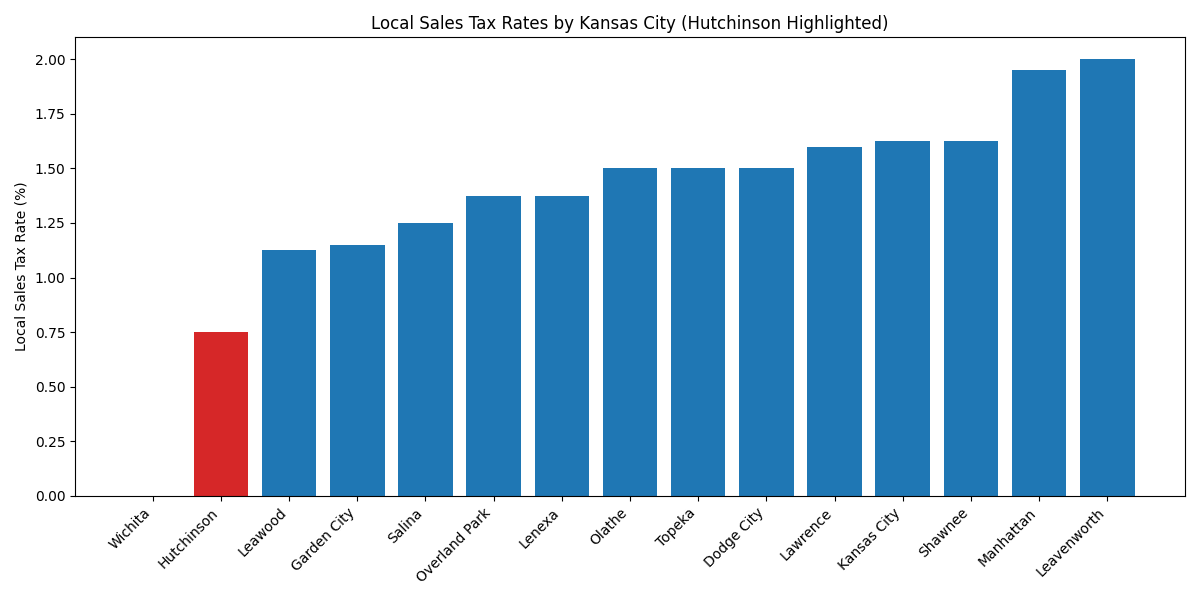

While Hutchinson residents often cite concerns about being among the most heavily taxed, several smaller cities already have higher local sales tax rates.

Seven cities have local sales tax rates of 3.0%. Those cities are Caney, Cherryvale, Coffeyville, Conway Springs, Independence, LaCrosse and Neodesha.

Here is the breakdown of the sales tax rates for the top 15 cities by population in Kansas.

The March 3 vote will determine whether Hutchinson joins a growing number of Kansas cities relying more heavily on local sales taxes to fund municipal operations and community priorities to keep property tax mill rates to a minimum.