MARC JACOBS

Hutch Post

Reno County officials are preparing for a 2026 budget year that could see modest spending increases, more investment in personnel, and a property tax levy that exceeds the state’s revenue neutral rate.

County staff began working on next year’s budget requests in February, first reviewing capital spending and then operating costs. Departments were directed early on to keep requests as flat as possible while human resources and administration projected the potential cost of wage increases and new positions.

The maximum budget now being presented to the county commission totals just over $91.1 million, compared to $87.1 million this year. That figure includes funds not supported by property tax revenue. The proposed maximum tax levy is $29.6 million, up about 12.6% from this year’s $26.3 million. To fund that, the county’s estimated mill levy would rise to 38.3 mills — an increase of 2.8 mills over the current rate.

According to county estimates, reaching the state’s Revenue Neutral Rate (RNR) of 34.008 mills would require an additional $3.3 million in cuts to the tax-supported portion of the budget. County officials have already made about $3.9 million in reductions to revenues, cash balances, and spending requests to reach the current proposed mill levy. Any further cuts, they warn, could have significant effects on county services and future budgets.

Personnel and Capital Highlights

Personnel costs are one major driver of the increase. The draft includes a total wage increase of about $850,000, covering a proposed 4% cost-of-living adjustment (COLA) for employees — equal to about $212,605 for every percentage point of increase. Staffing levels would see a net gain of 4.5 full-time equivalents (FTEs) across county departments.

The Sheriff’s Office is slated to receive three new Police Interceptor SUVs and a vehicle for administration and investigations, while Youth Services would get a transit van. Other vehicle requests were cut from the recommended capital improvement plan to help trim the budget.

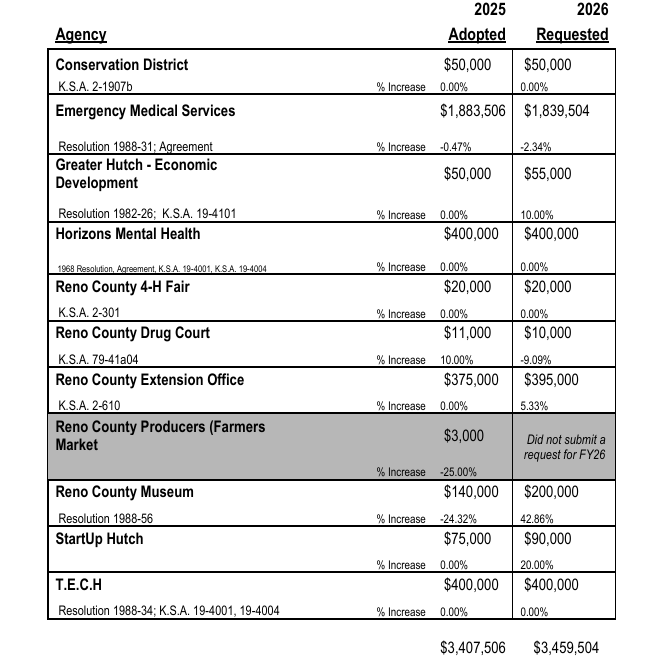

Like many local governments, the county continues to wrestle with the impact of inflation on everyday operating costs, including fuel and supplies. Partner agencies are requesting an overall increase of about $52,000 for next year.

Financial Picture and Cash Reserves

The county’s estimated assessed valuation has grown by about 4.28%, which would generate a tax levy increase even with a flat mill rate. A 2.8 mill increase would add about $32.20 a year in taxes for every $100,000 in residential property value.

Reno County aims to maintain a healthy General Fund cash reserve, which would equal about 13% of the fund’s expenditures, or roughly 1.5 months of operating cash. That is slightly below the two-month minimum recommended by the Government Financial Officers Association. The Employee Benefits Fund reserve stands at around 9% of expenditures.

Over the past 12 years, the county’s tax levy has risen at an average annual rate slightly higher than inflation — about 3.1% compared to 2.95% — while the mill levy rate itself has remained relatively flat.

Special Districts and Public Hearings Ahead

Most special fire districts, with the exception of Fire District #2, are expected to exceed the RNR because of rising costs and low assessed valuation growth in some areas. Consolidated Fire District #1, appearing for the first time in the budget, is estimated to levy about 10.16 mills. Sewer and water districts remain funded mostly by user fees.

Looking ahead, the county must notify the County Clerk of its intent to exceed the RNR by July 20. Public hearings on the RNR and the final budget must be held between August 20 and September 20, with final adoption and certification due by October 1.

County commissioners are expected to set the maximum budget amount this week. Even after that, there is still time to reduce expenditures before final approval — but no room to increase them.

County leaders say the proposed budget balances the need to maintain services and cover rising costs while limiting the burden on taxpayers as much as possible.